Global MVNO market growth trends

Speaking to Telstra Wholesale customers at the recent Business.Connect17 event, Nicole McCormick, Practice Leader of Ovum’s Broadband and Multiplay team, discussed MVNO market trends, growth and strategies to address the ‘changing digital consumer’.

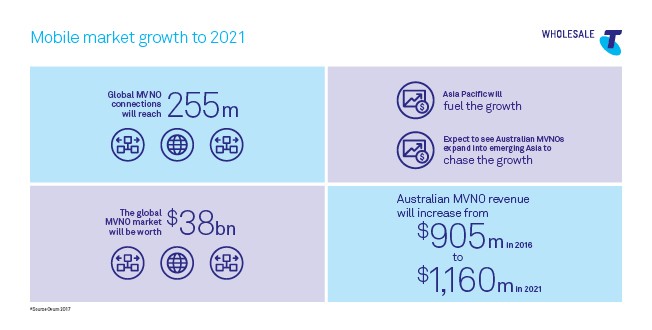

The global MVNO market continues to grow steadily and that trend looks set to be maintained over the next five years, with Ovum forecasting the number of MVNO connections will reach 255 million in 2021, in a market predicted to be worth $38bn.

Global MVNO Market Growth Trends

Speaking to Telstra Wholesale customers at the recent Business.Connect17 event, Nicole McCormick, Practice Leader of Ovum’s Broadband and Multiplay team, discussed MVNO market trends, growth and strategies to address the ‘changing digital consumer’.

The global MVNO market continues to grow steadily and that trend looks set to be maintained over the next five years, with Ovum forecasting the number of MVNO connections will reach 255 million in 2021, in a market predicted to be worth $38bn. But while Europe and the US have traditionally formed the bulk of the MVNO markets today, it is Asia-Pacific that will fuel this growth. Governments across the Asia-Pacific region are leveraging the MVNO market growth to increase domestic competition. This has given rise to a number of Asian MVNO powerhouses, who provide consumers with a fresh opportunity to satisfy their taste for new products and services.

Concurrently, markets such as China across the region are spurring their domestic scene to introduce MVNO business models. MVNOs are using key capabilities such as their ability to scale quickly, put in place the resource needed, while also being highly educated in the market they’re entering. MVNOs in Australia that have scale should leverage their experience to enter other markets in Asia, particularly emerging markets such as India where the government has now opened MVNO licensing for both fixed and mobile markets.

Revenue will increase in the Australian MVNO market from $905m in 2016 to $1,160m in 2021. The continued and predicted growth is of course very welcome for the industry, but it also acts as a catalyst for increased competition, and that means that MVNOs, including those in Australia, cannot rest on their laurels.

MVNOs cannot sit still

While the growth and percentage of MVNO connections in the Australian market is on a par with those in Asia (anticipated to reach 10.5 percent in 2021), the market is under pressure from aggressive local MVNOs looking to build market share, and from incumbent operators looking to regain ground they have lost to MVNO competition.

Globally, incumbents in some markets are launching sub-brands that compete with more generalist MVNOs targeting the value-seeking customer, as opposed to a very specific niche audience. The increase in competition has many other implications that MVNOs need to consider as part of their long-term strategies.

A rise in the number of players in any given market will have wider impacts on the range and choice of services on offer. This will lead to a change in consumer desires and tastes, something we’re terming the ‘changing digital consumer,’ which will be covered in my next article. This is something MVNOs will need to be across as they plan for the years ahead.

Global MVNO Market Growth Trends

Speaking to Telstra Wholesale customers at the recent Business.Connect17 event, Nicole McCormick, Practice Leader of Ovum’s Broadband and Multiplay team, discussed MVNO market trends, growth and strategies to address the ‘changing digital consumer’.

The global MVNO market continues to grow steadily and that trend looks set to be maintained over the next five years, with Ovum forecasting the number of MVNO connections will reach 255 million in 2021, in a market predicted to be worth $38bn. But while Europe and the US have traditionally formed the bulk of the MVNO markets today, it is Asia-Pacific that will fuel this growth. Governments across the Asia-Pacific region are leveraging the MVNO market growth to increase domestic competition. This has given rise to a number of Asian MVNO powerhouses, who provide consumers with a fresh opportunity to satisfy their taste for new products and services.

Concurrently, markets such as China across the region are spurring their domestic scene to introduce MVNO business models. MVNOs are using key capabilities such as their ability to scale quickly, put in place the resource needed, while also being highly educated in the market they’re entering. MVNOs in Australia that have scale should leverage their experience to enter other markets in Asia, particularly emerging markets such as India where the government has now opened MVNO licensing for both fixed and mobile markets.

Revenue will increase in the Australian MVNO market from $905m in 2016 to $1,160m in 2021. The continued and predicted growth is of course very welcome for the industry, but it also acts as a catalyst for increased competition, and that means that MVNOs, including those in Australia, cannot rest on their laurels.

MVNOs cannot sit still

While the growth and percentage of MVNO connections in the Australian market is on a par with those in Asia (anticipated to reach 10.5 percent in 2021), the market is under pressure from aggressive local MVNOs looking to build market share, and from incumbent operators looking to regain ground they have lost to MVNO competition.

Globally, incumbents in some markets are launching sub-brands that compete with more generalist MVNOs targeting the value-seeking customer, as opposed to a very specific niche audience. The increase in competition has many other implications that MVNOs need to consider as part of their long-term strategies.

A rise in the number of players in any given market will have wider impacts on the range and choice of services on offer. This will lead to a change in consumer desires and tastes, something we’re terming the ‘changing digital consumer,’ which will be covered in my next article. This is something MVNOs will need to be across as they plan for the years ahead.

But while Europe and the US have traditionally formed the bulk of the MVNO markets today, it is Asia-Pacific that will fuel this growth. Governments across the Asia-Pacific region are leveraging the MVNO market growth to increase domestic competition. This has given rise to a number of Asian MVNO powerhouses, who provide consumers with a fresh opportunity to satisfy their taste for new products and services.

Nicole McCormick, Ovum: The new digital consumer

Concurrently, markets such as China across the region are spurring their domestic scene to introduce MVNO business models. MVNOs are using key capabilities such as their ability to scale quickly, put in place the resource needed, while also being highly educated in the market they’re entering. MVNOs in Australia that have scale should leverage their experience to enter other markets in Asia, particularly emerging markets such as India where the government has now opened MVNO licensing for both fixed and mobile markets.

Revenue will increase in the Australian MVNO market from $905m in 2016 to $1,160m in 2021. The continued and predicted growth is of course very welcome for the industry, but it also acts as a catalyst for increased competition, and that means that MVNOs, including those in Australia, cannot rest on their laurels.

Nicole McCormick, Ovum: Strategies for differentiation

MVNOs cannot sit still

While the growth and percentage of MVNO connections in the Australian market is on a par with those in Asia (anticipated to reach 10.5 percent in 2021), the market is under pressure from aggressive local MVNOs looking to build market share, and from incumbent operators looking to regain ground they have lost to MVNO competition.

Globally, incumbents in some markets are launching sub-brands that compete with more generalist MVNOs targeting the value-seeking customer, as opposed to a very specific niche audience. The increase in competition has many other implications that MVNOs need to consider as part of their long-term strategies.

A rise in the number of players in any given market will have wider impacts on the range and choice of services on offer. This will lead to a change in consumer desires and tastes, something we’re terming the ‘changing digital consumer,’ which will be covered in my next article. This is something MVNOs will need to be across as they plan for the years ahead.

You can find more information about Telstra Wholesale's mobility solutions here.